Intra-commodity spreads or calendar spreads are made up of offsetting positions in two underlying contracts on the same commodity that have different expiration months, for example:- Long a July RBOB Gasoline contract and Short a September RBOB Gasoline contract. Calendar spreads are typically divided into bull and bear spreads. A bull spread is long the nearby contract and short the deferred contract with the anticipation that over the trade’s time horizon the nearby contract price will appreciate more than the deferred contract price. A bear spread is short the nearby contract and long the deferred contract with the anticipation that over the trade’s time horizon the nearby contract price will appreciate less than the deferred contract price.

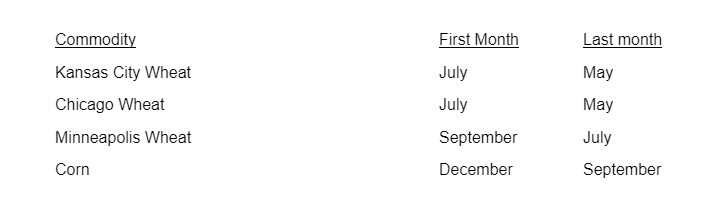

Intercrop spreads are a specific type of intra-commodity spread and are defined as long a contract month in one crop year and short a contract month in a different crop year. For example, the Soybean crop year is September through August, with soybeans in the US planted in May and June and harvested six months later between October and November. An intercrop spread example would be long a July 2022 Soybean contract and short a November 2022 Soybean contract. Intercrop spreads reflect in some cases radically different fundamental supply and demand conditions affecting the underlying commodity and as such, both the volatility and margin requirements associated with these spreads can be significantly higher than plain vanilla intra-commodity spreads.

Intra-commodity or calendar spread strategies offer a number of advantages over directional or flat price strategies which explains why their adoption has been so prevalent amongst sophisticated market participants. One major advantage is the reduced volatility typically associated with calendar spreads. This is an important consideration when evaluating them against outright positions and the majority of calendar spreads, due to their hedged nature, do exhibit reduced volatility of returns. However, there are certain spread relationships where the volatility of the spread can be significantly higher than the individual contracts. This is most notable in inter-commodity spreads, for example live cattle versus lean hogs and to a lesser extent inter-exchange spreads. Another limiting factor for spread strategies is the often reduced liquidity in the deferred contract months. Naturally this depends on the market, but the liquidity of the underlying contracts and time to first notice date should be monitored closely to avoid excessive slippage when entering or exiting a spread.

The reduced margin requirements associated with spread positions permit both greater diversification and greater precision when it comes to portfolio construction and evaluation of risk. The increase in diversification and ready access to margin data for exchange-recognized spreads also permits increased capital efficiency and targeting of risk-adjusted returns at both the trade and portfolio level.

Another important advantage is that most exchange-recognized spreads are quoted as spreads, rather than two separate positions and as such can be liquidated during limit moves in the underlying contracts. This is critical when considering position sizing, risk limits and portfolio construction and can not only mitigate losses but in many cases can help the portfolio to remain within pre-determined risk limits.

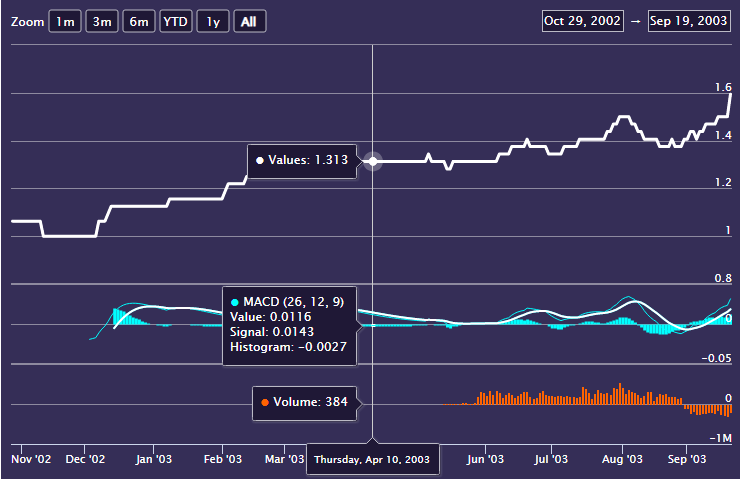

An often overlooked benefit of spreads is the insight gleaned from monitoring prevailing and historical spread relationships can be very useful for both spread traders and outright traders alike when considering which month to go long or short. Close attention to the relationships between spreads and their relative strengths and weaknesses can reveal the contracts that are the strongest and the weakest in the term structure and give clues as to whether a move is largely technical in nature or a fundamental change in market direction.